PGBL: deadline to deduct up to 12% on income tax ends in December

11/12/2024Receita Saúde: App will be mandatory in 2025 for medical expenses

18/12/2024HIGHLIGHTS

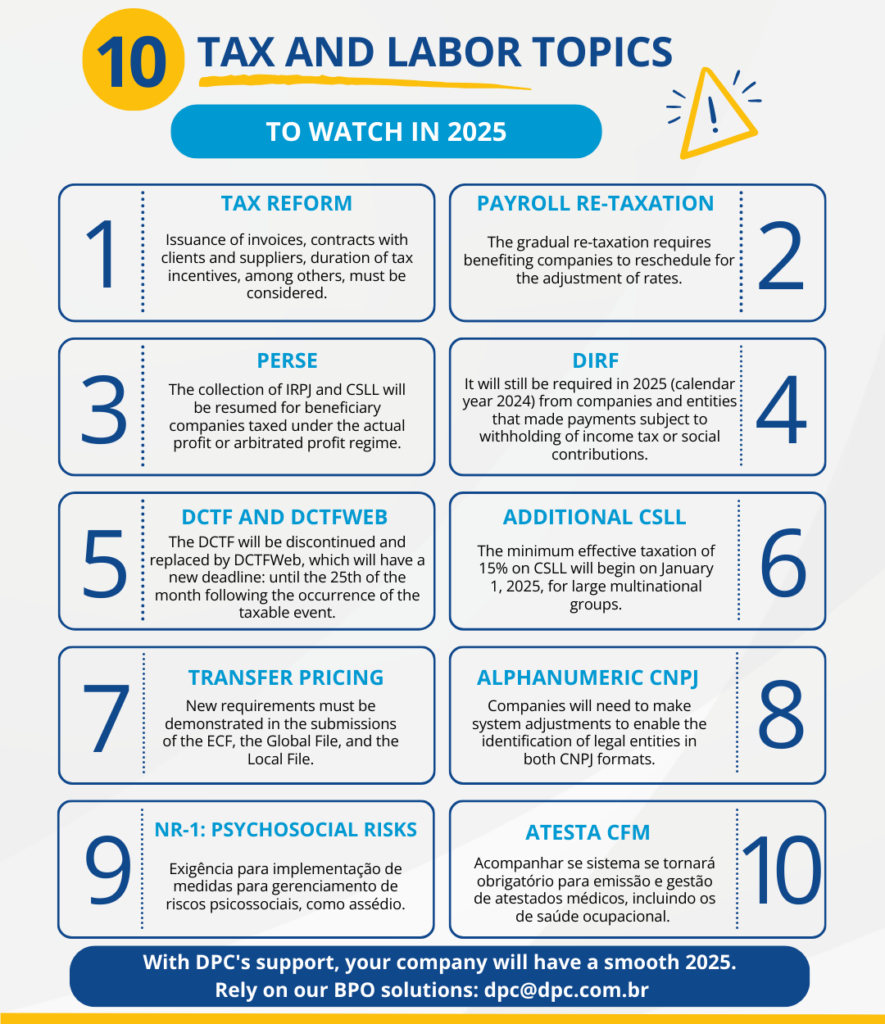

10 tax and labor topics to watch in 2025

Adapting to changes in the tax and labor fields is essential for businesses

The complexity of the tax and labor environment in Brazil requires companies to adopt an proactive approach at all times. Understanding what lies ahead and preparing for it is essential to face challenges and seize the opportunities the coming year holds.

Staying informed about new developments, seeking specialized guidance, and ensuring an integrated management of accounting, tax, and labor areas will be key factors for companies' success in this new cycle.

Below, we highlight some key points of attention for businesses in these areas in 2025.

Check a summary in the image and more details in the text.

1. Tax Reform

Tax reform remains at the forefront in 2025. In any case, taxpayers must closely monitor developments and prepare for gradual implementation starting in 2026, including the transition period during which both systems will coexist.

Impacts on invoice issuance, contracts with customers and suppliers, the validity of tax incentives, among other aspects, must be taken into account. Additionally, companies will need to plan changes to processes and systems as definitions in the tax field evolve.

2. Gradual Re-taxation of Payroll Taxes

The gradual re-taxation of payroll taxes, established by Law No. 14,973/2024, begins in 2025, requiring beneficiary companies to adjust their plans to accommodate changes in tax rates on gross revenue and payroll.

Year |

Rates |

|

Gross income |

Payroll |

|

|

2025 |

80% |

25% |

|

2026 |

60% |

50% |

|

2027 |

40% |

75% |

During this transition, the 13th salary payroll remains fully exempt. Starting in 2028, companies will resume paying the contributions in full.

The same regulation gradually reduces the additional 1% rate on Cofins-Importação. The tax decreases to 0.8% in 2025, 0.6% in 2026, and settles at 0.4% in 2027.

See more: Law extending payroll tax relief until 2024 approved

3. Perse

The Emergency Program for the Recovery of the Events Sector (Perse) reduces the PIS/Pasep, Cofins, CSLL, and IRPJ rates to 0% for a period of 60 months—from March 2022 to February 2027. However, the tax benefit may end earlier if the R$15 billion limit on government tax exemptions is reached.

Starting in 2025, IRPJ and CSLL will once again be charged for beneficiary companies taxed under the actual or estimated profit regimes. Companies under the presumed profit regime will remain exempt until 2026.

4. Dirf (Declaration of Income Tax at Source)

Much has been said about the end of the Dirf, but it is important to clarify: this annual ancillary obligation will still be required in 2025 (for the 2024 calendar year) and must be submitted by February 28 by companies and entities that made payments subject to Income Tax or social contributions withholding.

After coexisting with eSocial and EFD-Reinf throughout 2024, the Dirf will be definitively discontinued for taxable events starting January 1, 2025. Consequently, taxpayers must continue to update these systems monthly.

- eSocial: For information on the payment of salaried work, including the incidences for Withholding Income Tax (IRRF), its exemptions, and deductions.

- EFD-Reinf: For withholding income tax on services rendered, social contributions withheld at source (PIS, Cofins, and CSLL), and other payments, such as rent, pensions, and profit distributions.

5. DCTF e DCTFWeb (Statement of Federal Tax Liabilities)

The DCTF will also be discontinued, being replaced by DCTFWeb. This change requires companies to review their processes to ensure that information aligns with the new structure.

It is worth noting that, starting in 2025, DCTFWeb will have a new deadline and must be submitted by the 25th of the month following the occurrence of the taxable events (no longer on the 15th).

Also read: The Federal Revenue Service abolishes the DCTF and sets new rules for DCTFWeb in 2025

6. Additional CSLL (Corporate Tax)

According to Provisional Measure 1,262/2024, large multinational groups in Brazil—those with annual revenues of €750 million or more in the consolidated financial statements of the ultimate parent entity in at least two of the four fiscal years immediately preceding the year under review—will be subject to a minimum effective taxation of 15% on CSLL (Social Contribution on Net Income) starting January 1, 2025.

The Additional CSLL was introduced by the government as part of the process of aligning Brazilian legislation with the Global Rules Against Base Erosion - GloBE Rules.

7. Transfer Pricing

The changes regarding transfer pricing, established by Law 14,596/2023, were significant, requiring companies to reassess transactions with related parties abroad and many of their operational aspects.

With mandatory application starting from the 2024 calendar year, and given the complexity of the rules, it is ideal that the new practices have been in place since this legislative amendment was regulated by the Federal Revenue Service. In any case, by 2025, it will be necessary to adequately comply with the requirements, which must be demonstrated in the submissions of the ECF, the Global File, and the Local File.

8. Alphanumeric CNPJ

The Federal Revenue Service recently announced a change to the CNPJ format, which will become alphanumeric, combining letters and numbers. The transition will be gradual, with implementation expected to begin in July 2026. It is important to note that current CNPJs will not be affected and will remain valid.

Throughout 2025, companies will need to adjust their systems to identify legal entities under both CNPJ formats, ensuring smooth registration processes, issuance of invoices, and seamless communication with suppliers and clients.

Read more: Federal Revenue Service announces a new CNPJ with letters and numbers for 2026

9. NR-1: Pyschosocial Risks

Instruction No 1,419/2024 introduced the identification of psychosocial risks, including factors such as moral and sexual harassment in the workplace, into the text of NR-1. Starting in May 2025, companies will be required to implement measures to manage these risks, ensuring that employees do not experience mental health issues due to overwork or toxic environments. Obligations also include defining strategies to prevent harassment and workplace violence.

It is worth noting that the regulation further requires employers to prepare and maintain risk management documents and programs, ensuring their availability for potential inspection actions.

10. Atesta CFM

Atesta CFM is a platform designed for issuing and managing medical certificates, including those related to occupational health. Focused on preventing fraud, the platform enables the issuance, validation, and verification of medical certificates.

Starting in March 2025, the system was set to become mandatory by the Federal Council of Medicine, but a judicial decision has suspended its compulsory use. It will be essential to monitor developments on this matter in the coming months.

For companies, this mechanism offers a way to reduce illegal absenteeism and monitor employee health. Employers wishing to validate medical certificates must subscribe to the service and pay a fee. The submission of certificates will depend on the employee's consent.

Permanent monitoring

It is not uncommon for new legislation to emerge at the end of the year. Therefore, constant monitoring is advisable. Additionally, companies are encouraged to track sector-specific regulations, as these may impact their obligations and opportunities.

Fiscal and Labor BPO

With DPC’s support, companies can ensure a smooth 2025. The specialized team monitors changes in tax, labor, and social security fields, providing clients with technical guidance and supporting strategic decision-making. Rely on DPC’s BPO solutions for comprehensive assistance: dpc@dpc.com.br.

How can DPC help your company?

Domingues e Pinho Contadores has a specialized team ready to assist your company.

Contact us at dpc@dpc.com.br

See more

Sign up for our Newsletter:

Are you interested?

Please contact us, so we can understand your demand and offer the best solution for you and your company.

Rio de Janeiro

Av. Rio Branco 311, 4º e 10º andar - Centro

CEP 20040-903 | Tel: +55 (21) 3231-3700

São Paulo

Rua do Paraíso 45, 4º andar - Paraíso

CEP 04103-000 | Tel: +55 (11) 3330-3330

Macaé

Rua Teixeira de Gouveia 989, sala 302 - Centro

CEP 27910-110 | Tel: +55 (21) 3231-3700/p>