Professional Apprenticeship Programs – COVID-19

16/12/2020Telecom: DPC supports multinational by minimizing tax risks and avoiding relevant penalties

20/12/2020EXPERT OPINION

Tax planning 2021: what to consider achieving better results in the next year

Tax planning must consider a series of issues that make the assessment unique for each company

By Luiz Flávio Cordeiro

The end of the fiscal year is approaching in a scenario still very impacted by the consequences of the pandemic on business and the economy. And by facing this scenario, added to the uncertainties in the Brazilian legislation, that companies must be prepared for the next year preparing a 2021 tax planning.

The developments of the crisis must be considered and a tax reform is underway, however the annual planning requires companies to firstly look at their own peculiarities, earnings, and estimates.

Tax planning is indispensable, with a potential to optimize resources, indicate opportunities to take advantage of credits and benefits, contributing to the financial health and competitiveness of companies in this challenging period.

Option for a tax method: what to evaluate?

Opting for a tax method at the beginning of 2021 will be force throughout the calendar year. Therefore, the taxpayer must make a careful analysis of factors such size, segment, turnover estimative, profitability, and how market trend impact the business, among other items.

Size and segment may establish the method

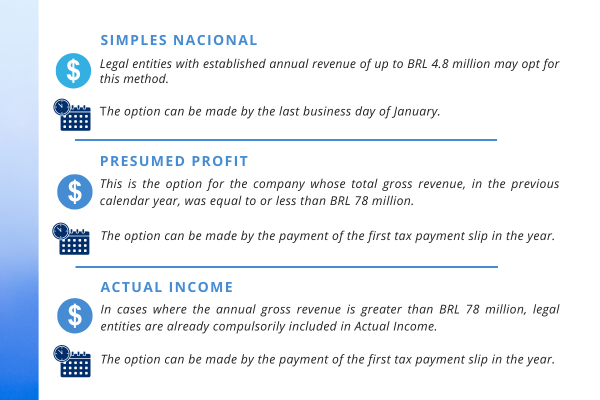

The features and situations that support the classification, and the deadlines for changing the model change are listed in the following chart:

The inclusion in the actual income method, in addition to being required for companies that have annual gross revenue greater than BRL 78 million, is also the only option for:

- companies operating in certain segments, such as banks, credit unions, private insurance companies, securities distributors and foreign exchange, among others;

- companies that recorded profits, income or capital gains from other countries;

- companies that explore purchases of credit rights resulting from credit sales or services (factoring companies);

- companies that have tax benefits concerning the relief or exemption from taxes.

In addition, this is the method used by publicly traded companies or companies in the IPO process.

Companies from other activities branches and which earned a gross revenue under BRL 78 million in the previous year are able to choose this taxation method, provided it is the most indicated.

See more: Actual Income: implementation, advantages and caution in choosing this taxation method

Taxpayers who do not fall under the mandatory terms are free to choose the method, paying attention to the current situation of the business, considering:

Profitability range

Knowing the profitability margin of the business is a crucial point for choosing the best path. For example, greater margins can benefit from the presumed profit.

A poorly performed planning can affect the company's income and cash flow.

Sales estimates

For 2021, the entrepreneur should be very attentive to what is expected for his own revenue. Is there an expectation of increase or should the company expect a decrease in revenues? In other words, it is necessary to understand the estimative of sales to evaluate the most advantageous tax regime.

And what about the progress of the tax reform?

The ongoing discussions lead to the understanding that the Actual income method would be a more advantageous option if the tax reform was approved along the lines of what is proposed by the government, which advocates the creation of the Contribution on Goods and Services (CBS), a Value Added Tax (VAT) unifying the PIS and Cofins.

With the single rate of 12% and the end of cumulative tax system, CBS would eliminate the advantage of presumed profit, a system widely used by the service sector and limited to companies earning revenues of up to BRL 78 million.

The law project should soon be voted at the Chamber of Deputies and, if approved, follow the other legislative procedures.

The matter must be monitored, and, if the reform is consolidated, companies may have a transition period until the implementation of new rules.

Strategic partnership for an efficient tax planning

In addition to considering the framing options, it is necessary to have an in-depth knowledge of the main and accessory obligations, tax benefits, tax opportunities and special schemes for each segment to achieve the best results with the annual tax planning.

Domingues e Pinho Contadores prepares a plan from all business’ particularities, such as area, size, turnover, profitability, estimates, and objectives. Rely on DPC’s advice for tax planning at this moment when is important to be surrounded by strategic partners to drive the growth in 2021.

Author: Luiz Flávio Cordeiro, Domingues e Pinho Contadores's partner and director , is based at São Paulo's office.

How DPC may help your company?

Domingues e Pinho Contadores has specialized team ready to assist your company.

Contact us by the e-mail dpc@dpc.com.br

See more

Sign up for our Newsletter:

Are you interested?

Please contact us, so we can understand your demand and offer the best solution for you and your company.

Rio de Janeiro

Av. Rio Branco 311, 4º e 10º andar - Centro

CEP 20040-903 | Tel: +55 (21) 3231-3700

São Paulo

Rua do Paraíso 45, 4º andar - Paraíso

CEP 04103-000 | Tel: +55 (11) 3330-3330

Macaé

Rua Teixeira de Gouveia 989, sala 302 - Centro

CEP 27910-110 | Tel: +55 (22) 2773-3318