DPC contributes to Subnational Doing Business in Brazil 2021, published by the World Bank

23/06/2021Brazilian Federal Revenue Office (RFB) – Exemption from the Need to Present Notarized Documents for Soliciting Services

25/06/2021HIGHLIGHTS

Rio de Janeiro's municipal government now requires the Annual Statement of IPTU Registration Information for individuals and legal entities

Created by Decree 48.985/2021, the Annual Statement of IPTU Registration Information (Declaração Anual de Dados Cadastrais do IPTU - DeCAD) is a new way of annually declaring, as from 2021, the registration information about real properties belonging to individuals or legal entities in the city of Rio de Janeiro, regardless if there are any changes or not in the building.

What is it for?

DeCAD is intended for taxpayers (individuals or legal entities) to inform the registration information of their properties to the local Tax Administration. The administration may use this information in its register, including for tax assessment.

What are the advantages of presenting DeCAD?

This is a way of keeping the real estate registration updated. By complying with this ancillary obligation, the taxpayer may get discounts on the payment of IPTU (Property Tax).

What kinds of real estate can be registered?

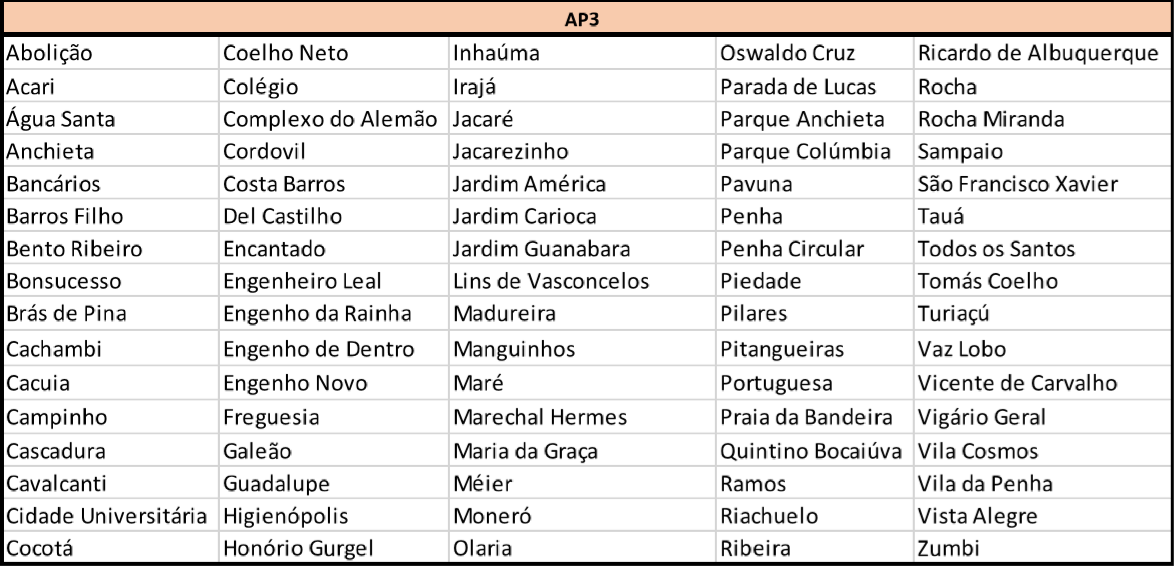

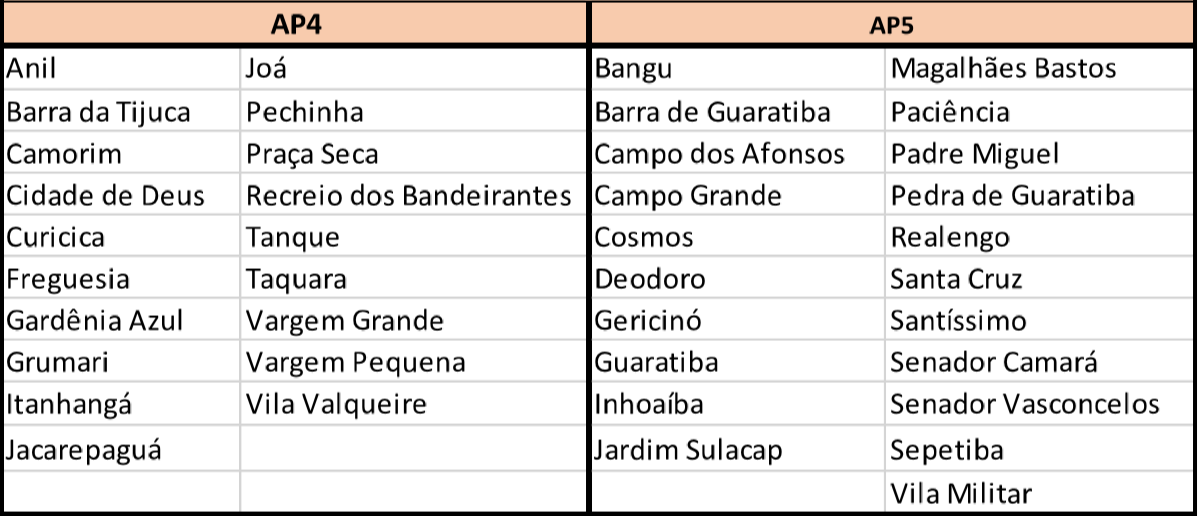

All types of real properties are included in the obligation. In 2021, however, DeCAD includes only houses and apartments, in the following areas:

What is the period for submitting DeCAD?

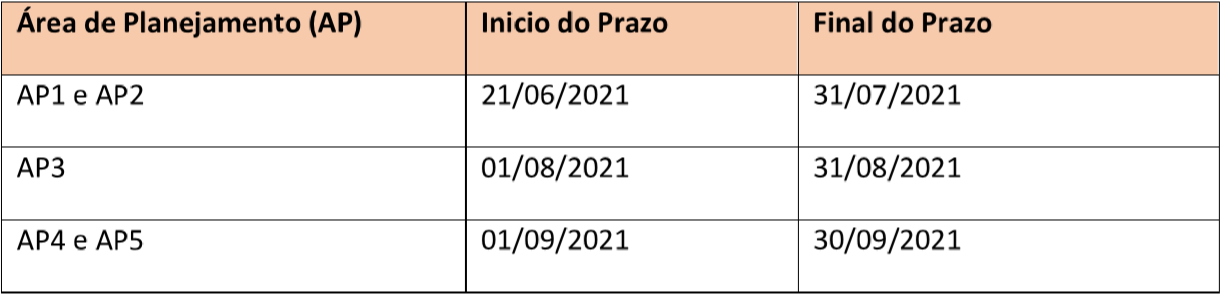

The statement must be submitted as from this year, 2021, and the period for submission is divided in three rounds, according to the area:

How to submit DeCAD?

DeCAD is delivered online, at the Carioca Digital website.

What happens in case of non-compliance?

Taxpayers who fail to comply with this obligation may sustain loss or reduction of benefits that could be eventually granted in cases of on-time payment. It may also lead to loss of spontaneity, resulting in retroactive collection of taxes due to differences in IPTU.

Other important details

It is worth mentioning that it is not possible to submit the statement if the property is not registered in IPTU or if it is registered as land, even though it is actually a house or apartment. In those cases, the taxpayer may start an administrative process.

If needed, taxpayers can amend DeCAD by submitting a rectifying statement after the normal statement previously presented. The deadline for delivering this amendment remains the same, that is, 07/30, 08/30 or 09/30/2021, depending on the area.

Support for DeCAD submission

Domingues e Pinho Contadores has a specialized team ready to support companies and individuals in complying with this new obligation, by carrying out all necessary steps and procedures for DeCAD submission. Contact us at dpc@dpc.com.br.

How DPC may help your company?

Domingues e Pinho Contadores has specialized team ready to assist your company.

Contact us by the e-mail dpc@dpc.com.br

See more

Sign up for our Newsletter:

Are you interested?

Please contact us, so we can understand your demand and offer the best solution for you and your company.

Rio de Janeiro

Av. Rio Branco 311, 4º e 10º andar - Centro

CEP 20040-903 | Tel: +55 (21) 3231-3700

São Paulo

Rua do Paraíso 45, 4º andar - Paraíso

CEP 04103-000 | Tel: +55 (11) 3330-3330

Macaé

Rua Teixeira de Gouveia 989, sala 302 - Centro

CEP 27910-110 | Tel: +55 (22) 2773-3318