Registration inconsistency leads to suspension of CNPJ for companies based abroad

17/11/2021

2022 tax planning: how to optimize business in an uncertain scenario?

22/11/2021ARTICLES

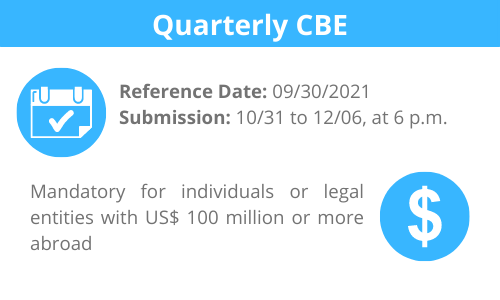

Submission of CBE for the 3rd quarter must be done by 12/06

The next submission of the quarterly declaration of Brazilian Capital Abroad (Capitais Brasileiros no Exterior - CBE) must be made to the Central Bank by 6 pm on December 6th, the business day immediately after the pre-fixed date for submission, December 5th.

This transmission refers to September 30, 2021. The obligation is required for individuals and legal entities residing in Brazil and holding assets abroad in an amount equal to or greater than US$100 million American dollars or the equivalent in other currencies.

Such values can be assets, rights, financial instruments, availability in foreign currencies, deposits, real estate, interest in companies, shares, bonds, trade credits, etc.

Penalties

Fines for non-submission, and for other cases described in the legislation, vary from BRL 2.5 thousand to BRL 250 thousand, with an increase of 50% in some cases.

Support for compliance with Bacen

DPC has a center specialized in complying with Brazilian Central Bank requirements that helps individual and corporate taxpayers to do registrations and submissions in full compliance. Count on this support: dpc@dpc.com.br.

How may DPC help your company?

Domingues e Pinho Contadores has a specialized team ready to assist your company.

Contact us by email at dpc@dpc.com.br

See more

Sign up for our Newsletter:

Are you interested?

Please contact us, so we can understand your demand and offer the best solution for you and your company.

Rio de Janeiro

Av. Rio Branco 311, 4º e 10º andar - Centro

CEP 20040-903 | Tel: +55 (21) 3231-3700

São Paulo

Rua do Paraíso 45, 4º andar - Paraíso

CEP 04103-000 | Tel: +55 (11) 3330-3330

Macaé

Rua Teixeira de Gouveia 989, sala 302 - Centro

CEP 27910-110 | Tel: +55 (22) 2773-3318